Naples Real Estate Sees High Demand in February

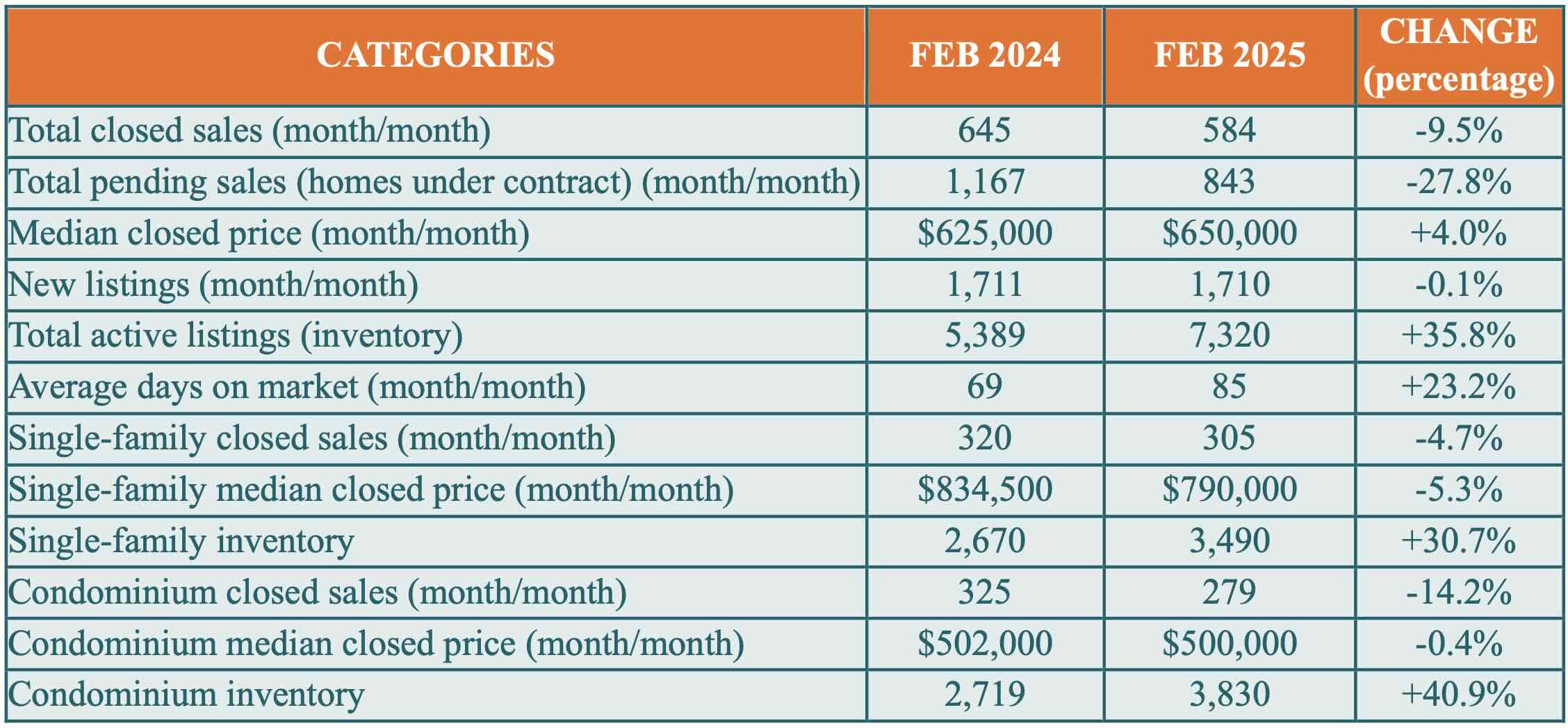

According to the February 2025 Market Report by the Naples Area Board of REALTORS® (NABOR®), which tracks home listings and sales within Collier County (excluding Marco Island), inventory increased 35.8 percent to 7,320 properties from 5,389 properties in February 2024. Overall closed sales decreased 9.5 percent to 584 closed sales in February 2025 from 645 closed sales in February 2024, but it increased 6 percent compared to closed sales reported in January 2025 (511 closed sales). And although the overall median closed price in February increased 4 percent to $650,000 from $625,000 in February 2024, the report also showed sellers taking action to stay competitive with 2,883 price decreases reported during the month to contend with the growing number of properties on the market.

The lax lending standards that ultimately led to a high number of foreclosures and short sales in 2007 is not occurring in 2025. Hughes and other brokers reviewing the February Market Report say today’s seller is better positioned than a seller in 2007 because most have built substantial home equity.

Diving into the Data

Broker analysts recommend working with a REALTOR® who understands the Naples market because market conditions vary widely based on home location and home type. For example, the February report shows the overall median closed price for properties in Naples increased 4 percent, but the median closed price for single-family homes in Central Naples [34104, 34105, 34116] decreased 28.7 percent. Conversely, the median closed price of single-family homes in the Naples Beach area (34102, 34103, 34108) increased 82.2 percent. Though this increase was more likely due to the sale of a few very high priced properties that created statistical disparity than actual organic price expansion. Similarly, the median closed price of condominiums decreased .4 percent in February; but in Ave Maria, the median closed price of condominiums increased 13.4 percent.

The NABOR® February 2025 Market Report provides comparisons of single-family home and condominium sales (via the Southwest Florida MLS), price ranges, and geographic segmentation and includes an overall market summary. NABOR® sales statistics are presented in chart format, including these overall (single-family and condominium) findings for 2025:

Brokers remarked that the Naples housing market is performing much better than other markets in Florida like Sarasota and Palm Beach. Dr. H. Shelton Weeks, Director of the Lucas Institute for Real Estate Development & Finance at FGCU’s Lutgert College of Business, added that “Collier County gets lost in the narrative when it comes to the media’s portrayal of housing market performance across Southwest Florida. People are seeing stories about oversupply in Charlotte and parts of Lee County and assume the same is true for Collier County, but that’s not the case.” New listings during February barely decreased (.1 percent) to 1,710 new listings from 1,711 new listings in February 2024. The added competition means sellers must be ready to meet the demand with asking prices that fit today’s market. During February, sellers were getting an average of 94.8 percent of their asking price. Of those buyers in February, 76.9 percent of them paid for the purchase in cash.