Home Prices Climb in May

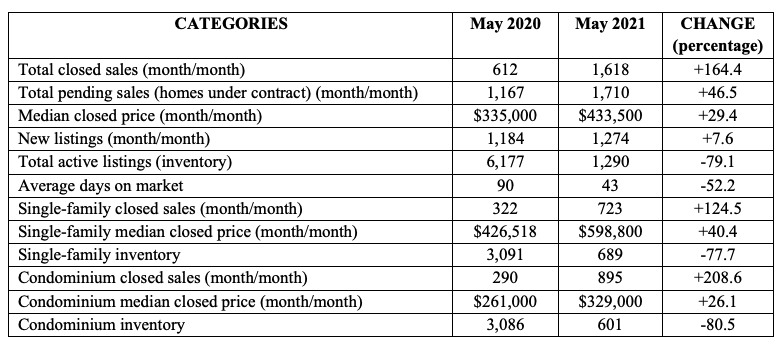

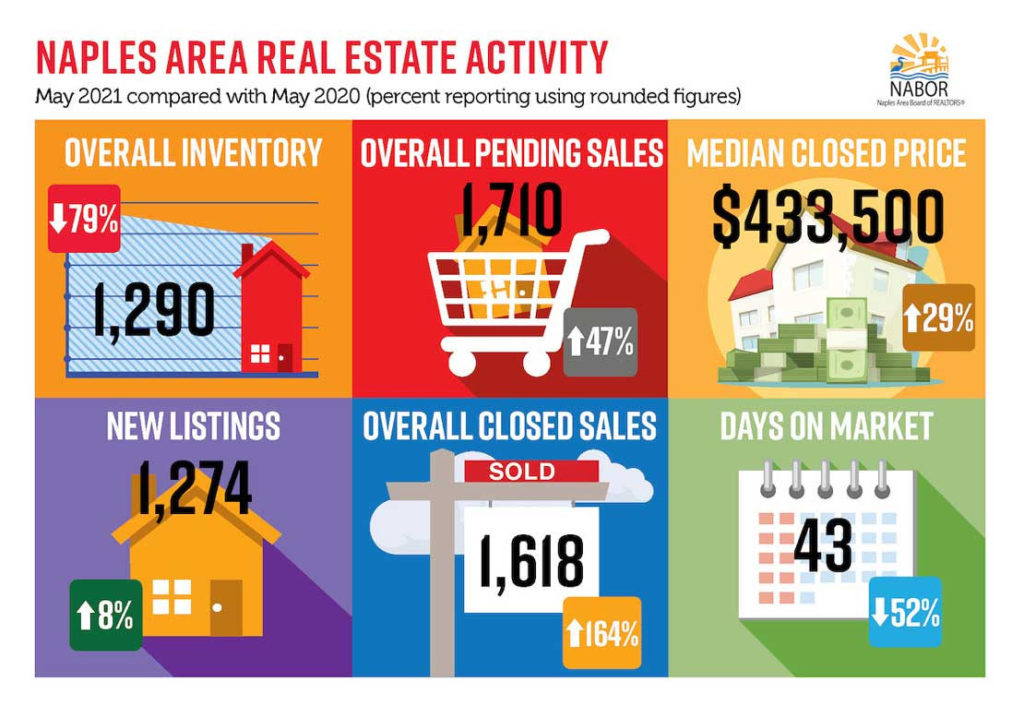

Homes in the Naples area were being sold at 99.1 percent of the list price in May. A tight inventory and buyer demand continued to push prices upward in May, which resulted in an overall median closed price increase of 29.4 percent to $433,500 from $335,000 in May 2020, according to the May 2021 Market Report released by the Naples Area Board of REALTORS® (NABOR®), which tracks home listings and sales within Collier County (excluding Marco Island).

Broker analysts reviewing the report predict continued price increases in 2021, but noted monthly showing and sales activity is beginning to show signs of deceleration from the remarkable market experienced during the first quarter of 2021.

“Some sellers have been asking about price wars,” said Molly Lane, Senior Vice President at William Raveis Real Estate. “This may not always be the best strategy as some buyers are weary of losing out and the seller may not get the desired result. It’s always best to consult with a REALTOR® as to the best strategy when pricing a home.”

Spencer Haynes, Vice President of Business Development and Broker with John R. Wood Properties, agreed with Lane and added, “A REALTOR® will help a seller price a home dead on the money or just a little below market to drive in offers. Buyers are getting keen on the tactic by some sellers to price way above value, and those sellers may not get the action they expect.”

Cash sales in May accounted for 58.4 percent of the closed sales transactions. The cash buyers continued to create challenges for competing buyers who required financing. It took an average of 90 days for a home to go from list to contract in May 2020, but in May 2021, the average days on the market was reduced to 43 days, a 52.2 percent decrease.

But the trend of paying cash for a home does not preclude those buyers who want to finance from purchasing a home. Buyers who are prequalified for a mortgage often fare well during negotiations and enjoy a faster closing process than those who are not prequalified. Also, as pointed out by Phil Wood, President & CEO of John R. Wood Properties, “Many capable cash buyers are leaving their money in the stock market because they can achieve a higher return there as compared to the low mortgage rates, of approximately 3.2%.”

The May Market Report showed overall closed sales increased 164.4 percent to 1,618 from 612 in May 2020 (a month when all the world was in COVID-19 lockdown). For perspective, closed sales increased 36 percent in May 2021 compared to May 2019 (a non-pandemic lockdown month). Nevertheless, closed sales activity in May 2021 outperformed any other May in the history of NABOR®’s market statistics reports.

The NABOR® May 2021 Market Report provide comparisons of single-family home and condominium sales (via the Southwest Florida MLS), price ranges, and geographic segmentation and includes an overall market summary. NABOR® sales statistics are presented in chart format, including these overall (single-family and condominium) findings:

Overall inventory fell 79.1 percent in May to 1,290 homes from 6,177 homes in May 2020, but monthly new listings activity continues. May welcomed 1,274 new listings, a 7.6 percent increase from 1,184 in May 2020. New listings that come on the market each month help to temper the drop in overall inventory and provide more opportunities to eager buyers.

“We’re in for a period of low sustained inventory,” said Budge Huskey, CEO, Premier Sotheby’s International Realty. “But even when demand begins to level off – perhaps in the second half of the year as is historically the case – our area will not see any real decline in prices because new fundamental values for our market are being set today and they are not likely to trend down again.”

Cash sales were not the only contributing factor to the drop in days on the market. Another factor was the 45 percent increase in showings for May (42,380 up from 29,319 in May 2020), which ultimately resulted in a 46.5 percent increase in pending sales for May to 1,710 pending sales from 1,167 pending sales in May 2020.

Historically, the Naples housing market’s activity in the first half of the year is not sustained during the second half of the year. However, since tourism to Florida is expected to increase this summer and buyers from foreign countries may also begin to arrive in the coming months, a return to more normalized buying behavior in the second half of the year was discussed although remains uncertain.

The Naples Area Board of REALTORS® (NABOR®) is an established organization (Chartered in 1949) whose members have a positive and progressive impact on the Naples Community. NABOR® is a local board of REALTORS® and real estate professionals with a legacy of nearly 60 years serving 6,000 plus members. NABOR® is a member of the Florida Realtors and the National Association of REALTORS®, which is the largest association in the United States with more than 1.3 million members and over 1,400 local board of REALTORS® nationwide. NABOR® is structured to provide programs and services to its membership through various committees and the NABOR® Board of Directors, all of whose members are non-paid volunteers.

The term REALTOR® is a registered collective membership m ark which identifies a real estate professional who is a member of the National Association of REALTORS® and who subscribe to its strict Code of Ethics.