June Real Estate Market Shows Signs of Balancing

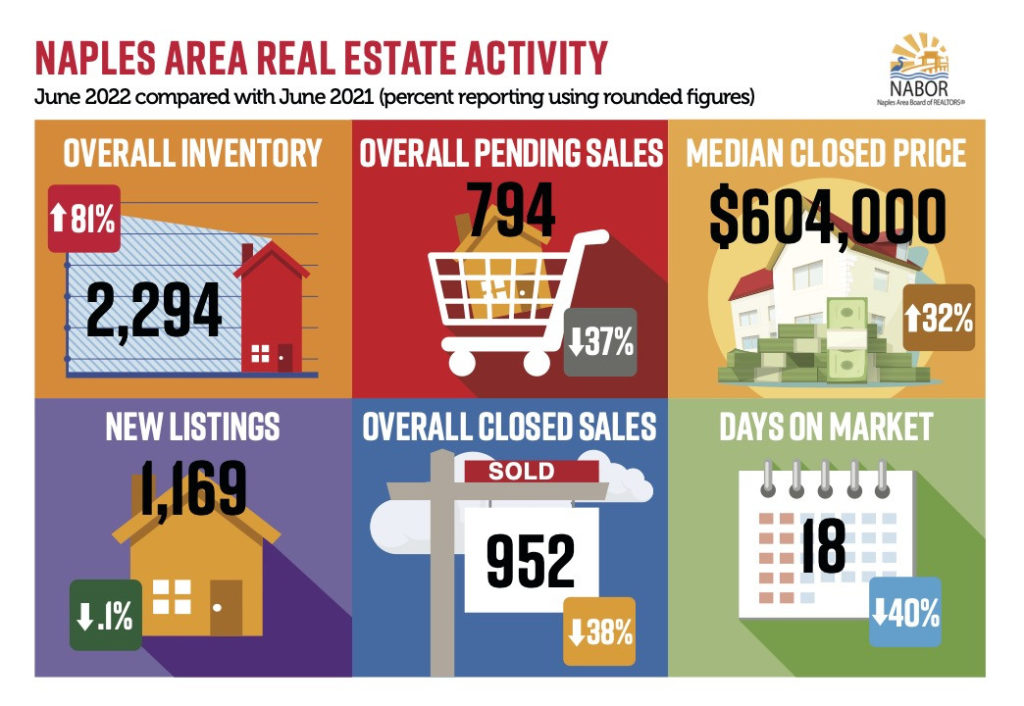

Data reflecting activity in the Naples area housing market during June showed signs of a return to pre-pandemic summer activity when market conditions were balanced. According to the June 2022 Market Report by the Naples Area Board of REALTORS® (NABOR®), which tracks home listings and sales within Collier County (excluding Marco Island), pending sales decreased 36.8 percent in June to 794 pending sales from 1,236 pending sales in June 2021, and closed sales decreased 38.4 percent in June to 952 closed sales from 1,545 closed in June 2021. On the positive side, an 80.5 percent increase in inventory during June to 2,294 properties from 1,271 properties in June 2021 is expected to spark sales.

With 2.2 months of inventory available in June (up from .8 months in December 2021), the journey back to a balanced market is starting to take place. But broker analysts say it will be a slow climb. Huskey added that, “We will remain in a sustained low inventory environment this year, which will serve to insulate prices. In almost all segments of the market, it will prove a story of deceleration rather than depreciation.”

The June Market Report showed 1,169 new listings compared to 1,170 new listings in June 2021. Broker analysts reviewing the report predict sales activity will continue to mirror 2019 trends, which will naturally increase inventory levels and return us to a balanced market.

The NABOR® June 2022 Market Report provides comparisons of single-family home and condominium sales (via the Southwest Florida MLS), price ranges, and geographic segmentation and includes an overall market summary. NABOR® sales statistics are presented in chart format, including these overall (single-family and condominium) findings for 2022:

Median closed prices in June increased 31.8 percent to $604,000 from $458,281 in June 2021, but median closed prices for single family homes in June decreased 7.7 percent to $750,000 from $812,500 in May. Conversely, median closed prices for condominiums in June increased 2.5 percent to $497,000 from $485,000 in May.

Huskey’s observation of the return of seasonality this year is supported by a recent member survey by the American Automobile Association (AAA) which – despite rising costs for gasoline, hotel rooms and airline tickets – reports, “consumer confidence regarding travel is the highest it’s been since the pandemic first began.” But Florida faces more competition this summer as other popular summer travel destinations that were previously off limits due to COVID-19 restrictions are now receiving visitors.

Despite the cooling of sales in June, cash sales during the month commanded 60.3 percent of all closed sales compared to 63.3 percent in May.